Many retailers and online stores have investigated and implemented alternative payment options to make it possible for consumers to purchase products even if they don’t have the cash on hand. These options include flexible financing and monthly installment payment plans through third parties.

This reduces some financial strain on consumers by allowing them to "buy now, pay later." Some of these third-party apps include Afterpay, Affirm, Klarna, and PayPal (through their solution called Pay 4).

Go Hearing offers customers the option of paying through Klarna to make the purchasing experience easier. Find out more about Klarna and how it works below.

What is Klarna?

Founded in 2005 in Stockholm, Sweden, Klarna has since expanded its payment solutions to 205,000 merchants in nearly 20 countries and is used by approximately 90 million shoppers. Their promise to consumers is: “Klarna is the smoothest & safest way to get what you want today and pay over time. No catch. Just Klarna.”

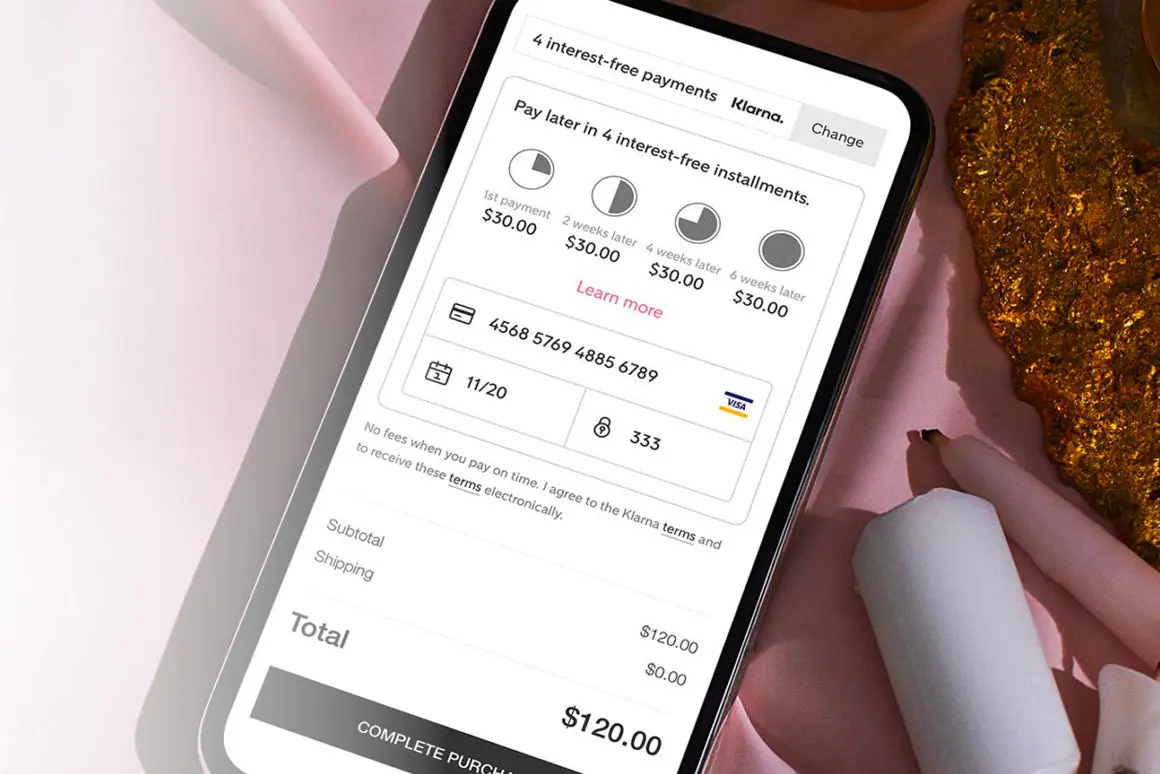

Klarna allows consumers to "buy now, pay later" by securing a small loan for both online and in-store purchases through the Klarna app. There are four different payment options: pay in 4 interest-free payments, pay in 30 days, get monthly financing, or pay immediately with a debit or credit card.

Is a credit check needed?

In some cases, Klarna may perform a soft credit check. However, this does not affect your credit score, and no minimum credit score is required.

How does Klarna work?

To use Klarna, you must download the app and set up your account.

Steps to get started with the Klarna app:

- Download the Klarna app from the Apple App Store or Google Play Store.

- When you open the app, you will be prompted to create an account and enter your email address. A code will be sent to your email, which you will need to input into the Klarna app to verify your identity.

- Next, you will be prompted to add a phone number to connect to your account. A code will be sent to your number, which you will need to input into the app to verify your identity.

- Klarna will ask for your permission to track you. You can deny it.

- You will be directed to a page to find stores that accept in-store Klarna payments.

- Tap the back button to return to the Home screen and start exploring the Klarna app.

Using Klarna to buy Go Hearing Aids

Consumers can now easily purchase their Go hearing aids by using Klarna as a payment option.

Follow these steps:

- Visit www.gohearing.com and choose the hearing aids that best fit your needs.

- Add your Go hearing aids to your cart and proceed to checkout.

- Complete your details and choose “Klarna - Flexible payments” as your payment option.

- After clicking “Complete order,” you will be redirected to Klarna to complete the purchase securely.

- From there, you will choose your preferred payment option and enter your card details.

- Confirm the amount and complete the payment.

How to shop on the Klarna app

You can follow these easy steps to shop directly on the Klarna app. Keep in mind that all of the following steps are performed directly in the app:

- From the home screen of the Klarna app, select the "Shop online" option.

- Search for the retailer you’re interested in purchasing from, such as Go Hearing or Walmart.

- Some retailers may ask you to sign in to your account.

- Add all the items you want to purchase to your cart and press the pink Klarna button.

- Klarna will then create a secure, one-time card.

- Approve the amount and other details, like shipping and taxes, then select "Continue."

- A soft credit check may be performed, but this doesn't affect your credit score.

- Klarna will also ask your permission to increase the amount you’re about to spend to cover shipping and tax.

- Enter your details like name, birth date, and address.

- Agree to the terms by selecting "Confirm and continue."

- Select the payment plan you prefer. For instance, you may see:

- 4 payments every two weeks at 0% APR

- 6 monthly payments with interest

- After choosing your preferred payment method, select "Continue." You will then need to add your bank or credit card info.

- Save your card info, review your plan, and select "Confirm and continue."

- Klarna will then let you copy the details of your one-time card.

- When done, exit the pop-up in the Klarna app to return to the retailer.

- From the retailer's checkout screen in the Klarna app, add a new payment method.

- Klarna will offer to paste/apply your one-time card info, or you can do it manually.

- Whichever option you choose, add the card, choose your billing address, and place the order.

How to shop in-store with Klarna

Follow these steps when you want to use Klarna to purchase in-store:

- Open the Klarna app on your smartphone and select the "In-store" option on the home screen.

- Set up your in-store card. This requires a valid debit or credit card, and you will only need to do this once.

- Your card needs to have at least 25% of the total amount you're hoping to spend.

- Amex and prepaid cards are not accepted.

- Your card will be available in Apple Wallet or Google Play. This card is for in-store use only.

- You can then shop at any terminal that accepts Apple Pay or Google Pay.

- After completing the setup process, select "Yes, I'm ready to start."

- Enter the amount you wish to spend, then continue.

- A soft credit check may be performed, but it doesn’t affect your credit score.

- Klarna will also ask your permission to add extra funds to cover shipping and tax.

- Klarna will offer its "Pay in 4" payment plan option with a link to see more details.

- You may be asked to enter your bank or credit card info.

- If you've already added your details, simply review your plan and hit "Confirm and continue."

- Your in-store card will be created.

- Select "Next" and agree to the terms.

- Klarna will show you how to use Apple Pay or Google Pay and tell you how long the card is valid (most cards are only valid for 24 hours).

Get to know Klarna’s payment plans

Klarna offers four payment options: Pay in 4, Pay in 30, Financing, and Pay Now. It's important to note that each retailer can decide which of these options they want to make available. Klarna bills automatically through the debit or credit card used during payment.

Pay in four equal installments

Pay in four equal installments every two weeks. See legal terms here.

The first installment is due at checkout, and it will be the balance divided by four.

There is no interest. Should you be late with a payment, there will be a fee of up to $7.

Pay in 30 days

Pay the full balance after 30 days. Nothing is due at checkout. See legal terms here.

There is no interest or late fee. However, if you do not make the full payment, you might go into default.

Financing

Pay with a small loan ranging from 6 months to 36 months. See legal terms here.

Interest ranges from 0% to 29.99%, with 19.99% for standard purchases.

Late payment fees can be as high as $35.

Pay now

Pay with your debit or credit card through the Klarna app. See legal terms here.

Pay the full balance at checkout. This option is ideal if you have extra funds and want to close out your loan.

Feel free to reach out to Go Hearing’s team of product experts if you have any questions or need guidance. You can call them at (302) 754-3190.

Written by Adel Van Eeden